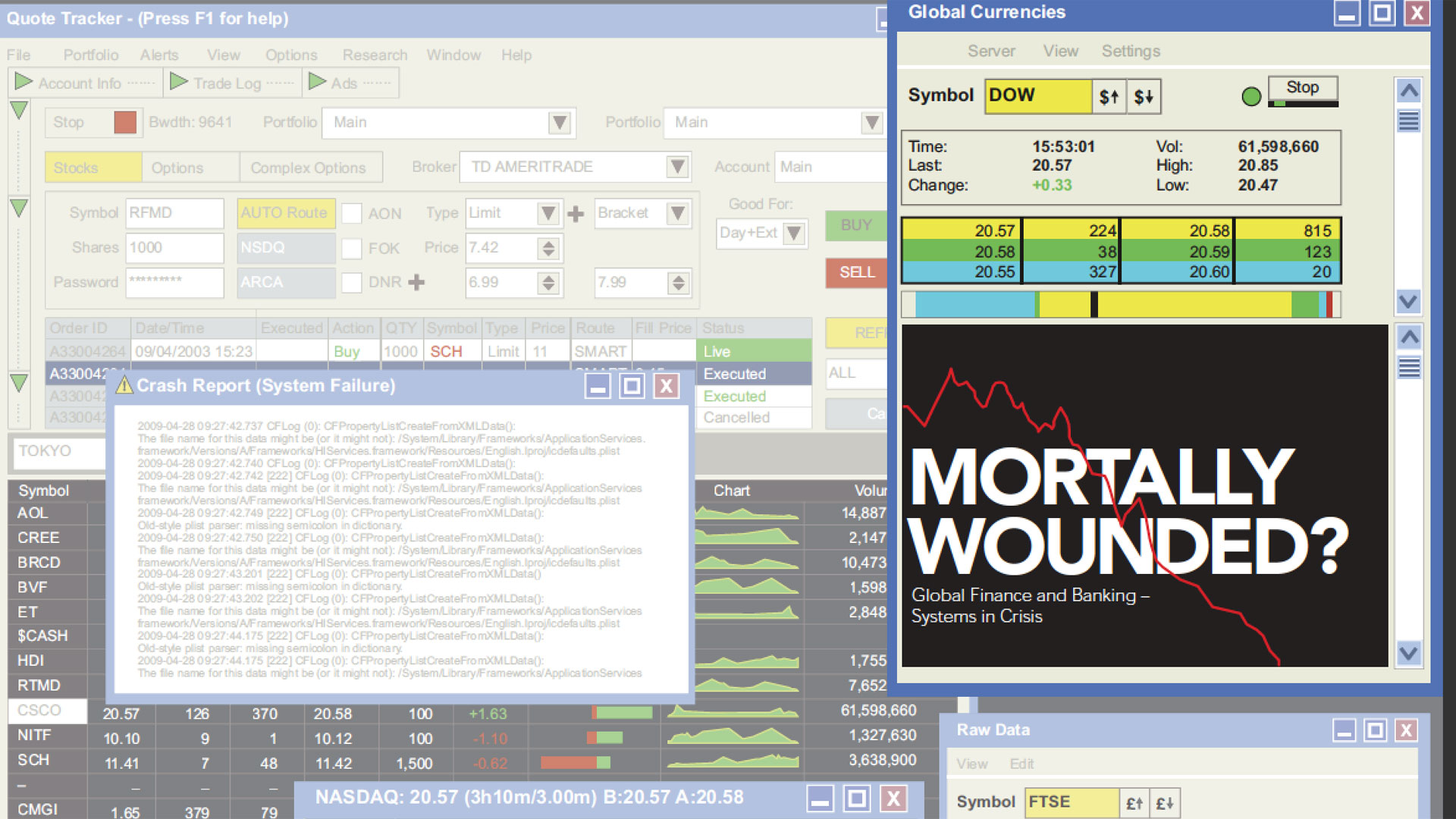

Mortally Wounded?

Global Finance and Banking—Systems in Crisis

“A series of secret calls took place between the world’s leading central banks,” reported the London Times. “Ben Bernanke, chairman of America’s Federal Reserve, and [Mervyn] King at the Bank of England were said to be instrumental in driving the action plan forward. Their market specialists then worked out the fine details.” The massive venture by the U.S. Federal Reserve, central bank for the world’s largest economy, in conjunction with the Bank of England, the European Central Bank, the Swiss National Bank and the Bank of Canada was an admission that the global monetary system was critically ill and that they needed to do something, as the central bankers expressed it, to “address elevated pressures in short-term funding markets.” Those meetings led to a joint announcement from the world’s central banks of their intention to infuse multiple billions of dollars into the system—an action taken almost immediately following the announcement. The Times characterized it as “the equivalent of the central-bank cavalry arriving to head off a massacre in the money markets.”

It might sound like autumn 2008, but in fact these events took place a year earlier, from November to early December 2007.

By March 2008 the Federal Reserve had “flooded credit markets with liquidity,” in the words of the Economist (March 22, 2008), and America’s fifth-largest investment bank, Bear Stearns, had to be thrown a lifeline. The bailout was seen not simply as the rescue of Bear Stearns but of what the Economist called “the marvelous edifice of modern finance,” Wall Street. Further, in an effort to stimulate the economy and avert a looming financial collapse, the Federal Reserve cut the federal funds rate (the target interest rate they would like banks to charge when lending money to one another). The week of March 16 was also a busy time for the European Central Bank, the Bank of England, the Bank of Japan and other central banks as they, too, worked to create liquidity without creating inflation in their respective economies.

By July 2008, irrepressible entropy had taken command of the world’s financial system. In September the U.S. government rescued Fannie Mae and Freddie Mac (the nation’s mammoth government-sponsored but privately held mortgage companies), and at least in America, the fear of an outright collapse of the U.S. financial system was palpable. September also brought the bankruptcy of Lehman Brothers, the sale of Merrill Lynch to Bank of America, and the bailout of American International Group (AIG).

The carnage progressed steadily through the remainder of the year, and fear turned to terror as we got a glimpse of the truly global nature of the financial catastrophe unfolding before us. No nation or bank was out of reach. The Dutch, German, French and Swiss governments each provided billions of dollars to rescue major banks in their respective countries. The U.K. government took an equity position in Royal Bank of Scotland and Lloyds TSB, while the United States announced its intent to buy significant numbers of shares in Bank of America, JPMorgan Chase, Wells Fargo, Citigroup, Morgan Stanley and Goldman Sachs. Ireland, Denmark and others also had to step in to rescue their financial institutions. The economic cyclone continued to move around the earth. Even the highly profitable Chinese banks and the heretofore stable Australian banks braced themselves for the storm.

This Time Is Different?

That our global finance and banking systems are critically ill is not news. For more than a year the media have bombarded us with updates on the worsening condition. Those in the financial press have often portrayed the contagion now devouring financial institutions and markets worldwide as a new, more virulent strain of the infections that occasioned previous financial crises. That depiction has spawned a real if unspoken fear that the system is in fact mortally wounded.

So how different is this crisis? Not different at all, according to Carmen M. Reinhart (University of Maryland professor of economics and former deputy director at the Research Department of the International Monetary Fund [IMF]) and her colleague Kenneth S. Rogoff (Harvard professor of economics and former chief economist and director of research for the IMF). In a paper published in April 2008 titled “This Time Is Different: A Panoramic View of Eight Centuries of Financial Crises,” Reinhart and Rogoff concluded that “the 2007–2008 US sub-prime financial crisis is hardly exceptional.” That conclusion was based, as they put it, on “a ‘panoramic’ analysis of the history of financial crises dating from England’s fourteenth-century default to the current United States sub-prime financial crisis.” The study analyzed “external and domestic debt, trade, GNP, inflation, exchange rates, interest rates, and commodity prices” for 66 countries in Africa, Asia, Europe, Latin America, North America and Oceania.

“Periods of high international capital mobility have repeatedly produced international banking crises, not only famously as they did in the 1990s, but historically.”

For Reinhart and Rogoff, the data are unequivocal: “serial default remains the norm, with international waves of defaults typically separated by many years, if not decades.” A review of their facts indicates that, in the last 200 years, these massive defaults have occurred approximately every 50 years. Although these writers don’t make the connection, this interval suggests, among other things, a generational component: at least once in an average human lifetime, we all experience a major international financial crisis; the system is forced into a painful correction, and the cycle begins anew.

Any notion on the part of policy makers and investors that “this time is different” is “illusion,” according to these economists. They also point out that high inflation, currency crashes and debasements often go hand-in-hand with default. And “historically,” they point out, “significant waves of increased capital mobility,” such as we witnessed in the latter decades of the 20th century and in the first six years of the 21st, “are often followed by a string of domestic banking crises.”

Such default periods clearly come to an end, even though their duration is unpredictable. According to Reinhart and Rogoff, from 1800 to 1945 the median duration of default episodes for national debts was six years. After World War II it was three years. One could debate the reasons. The more interesting fact revealed by the data is that once a default resolution has been effected and debt restructured, countries are quick to releverage—that is, to incur more debt. Such behavior has all the hallmarks of an addiction, and yet somehow the system survives. In all likelihood it will this time as well.

A Balancing Act

Perhaps the issue is not whether the system is mortally wounded but whether it is fundamentally flawed. Reinhart and Rogoff have documented nearly a millennium of national indebtedness—public and private—that leads to default, bank failures, currency devaluation and debasement, and inflation. But why does it lead to these problems?

When industrialized nations implement monetary policy, their goal is to create a stable national economy. They do this by monitoring and controlling interest rates and money supply. Governments exercise their fiscal policy, and thus affect the direction of the economy, through taxation and government spending. The accepted structure by which they do this is known as central banking, one of the primary functions of which is to control both the creation and the quantity of money that circulates in a nation’s economy. In theory, the amount of money in the economy is the amount required to achieve a balance between what is produced in goods and services and what is paid for those goods and services. Stability is achieved when the values in an exchange are equal: the amount of money paid accurately represents the value of a purchase. So a primary function of central banks is to produce and maintain stability through monetary policy.

If the amount of money in circulation exceeds the amount and therefore the value of goods and services produced, then prices and/or production will increase. This is because there is more money than there are goods and services at the prevailing price. The reverse is also true: when the money supply contracts, prices typically decline. Money should facilitate an exchange of goods and services. It should not disrupt the equilibrium between production and the value to the marketplace of goods produced.

The myriad of problems in housing markets today is a good example of how too much money perverts value. Lenders made low-interest mortgage money available to many thousands of people who could not afford to make the payments. The initial effect of this easy money was the artificial inflation of home prices. When the economy slowed and people quit making their mortgage payments, the entire housing market was destabilized. That was the catalyst for the current crisis in the financial sector.

At Debt’s Door

Debt, of course, is a fundamental aspect of any economic system. But to appreciate just how dependent we are on debt for money we need only observe the effect on the economy of a contraction in credit and lending—like the one we’re seeing today. We are addicted to debt as our chosen method for producing economic growth and prosperity. And so long as we are, we will continue to fall victim to the “default episodes” that are part of the historic reality of this system.

It is ironic that despite all the wealth, innovation, technology and seeming prosperity in industrialized societies, most people in those societies are heavily in debt. The people who actually produce all the real wealth in the real economy are in debt to those who create the money that represents that wealth. And we are not just in debt for the principal amount of the loan; we owe interest as well. The conundrum is that banks create money for the principal amount of the debt but not for the interest. Yet borrowers are legally obligated to repay principal and interest from a money supply that essentially consists only of the amount of the principal.

It is the time lag between money’s creation as a new loan and its repayment that prevents this shortage from creating defaults. When an economy functions poorly, however, or not at all, time is compressed and the fundamental flaw in the system is exposed.

The solution to this problem has been to create more debt to subsume existing debt, which now consists of both unpaid principal and interest. And although debts are occasionally forgiven, for individuals or nations to function economically they must incur more. Ours is a system that chains us to a perpetually escalating and inescapable spiral of mounting indebtedness. The proverb is true: “The rich rules over the poor, and the borrower becomes the lender’s slave” (Proverbs 22:7, New American Standard Bible)—an apt description of this world’s monetary system.

So many elements of this system need to be reexamined. The fact that interest is assessed on principal that does not exist but is essentially created out of nothing—is that moral?

Then there is the notion that we can create perpetual economic growth year after year by constantly leveraging our future. Doesn’t the history of the past 800 years (as outlined by Reinhart and Rogoff) inform us that there is a reckoning not far off in our future? When we know there is and yet we leave the mess for the next generation to clean up, how can that be right?

In the debtor-creditor relationship, the creditor dominates and has the power to oppress. Can justice ever be created when there is such disparity in power and the system provides no equalizing force? Should we not, by law, implement a structure that neutralizes that power to prevent the oppression of the debtor (usually the poor)?

Finally, the use of credit is the use of leverage: force. Leverage is fundamental to the way we grow an economy and keep it growing in perpetuity. Development in the real economy never occurs as quickly as we can create debt in an effort to force economic growth; so we have credit defaults.

There is a larger problem, however. To sustain the debt we create, we must actually produce in the real world. That is a world of finite resources. How long, and for how much of this earth’s population, can we strip resources from the earth and turn them into garbage before the earth ceases to sustain life—even our lives?

Generating Interest in Principles

One definition of insanity reasons that it is insane to do the same thing the same way again and again, all the while expecting a different result. By that definition, 800 years of insanity should be sufficient.

As already noted, we have experienced a global credit default approximately every 50 years for at least the past two centuries, roughly the period of British and U.S. hegemony in finance. This means that each generation is essentially paying for the “sins” of another.

Because infinite growth in a finite world is truly impossible, why not protect future generations by constructing a system that ensures that children will not have to pay the debts their parents incur?

What if, instead of ramping up debt to leverage growth, we established a structure that required credit markets to reset periodically, say every seven years. Lenders would exercise great care in extending credit, because they would know that in the year credit reset, they would have to write off any outstanding balance. There would be no inducement to lend to those who could not repay within the prescribed time period. The creation of money to be used to speculate in the markets would be a thing of the past. There would be no incentive to inflate an appraisal used to support a loan in order to earn a greater return on that loan. Nor would a lender be motivated to boost the value of assets held as collateral in order to lend more money than a borrower could repay, in the hope of taking possession of that collateral, because it would have to be released once the debt was satisfied. Such a regulation would go a long way toward neutralizing the disparate power structure of the debtor-creditor relationship and eliminating many of the serious injustices that our modern system so easily creates. And it would place a ceiling on the use of credit in the economy and link the issuance of credit to the economy’s real output, thereby eliminating the serial default problem we have experienced for at least the past 800 years.

Implementation of this regulatory scheme would require a complete restructuring of the manner in which interest on loans is assessed. Interest on money created as debt in our world is charged on money that is created from nothing but the borrower’s promise to repay. That means that regardless of the nominal or stated rate of interest, the real interest rate is 100 percent. Unlike interest on credit in our world, the amount would have to be reasonable, with no additional fees, and it would have to be assessed on real wealth already in the economy. This feature eliminates the injustice created when lenders create, and infuse into the economy, only the principal amount of the loan.

It is impossible to regulate the use of credit in an economy without considering real estate, because real estate, both rural and urban, forms the basis of our economies. Regulation in this area begins with who owns the land. Only then can a thoughtful scheme for land use and development, financing, and alienation (transfer of the ownership of property rights) be structured. Suffice it to say that we’ll need to implement something radically different than what we see in our world today before we can achieve the balance necessary to provide a viable and stable economy throughout the world.

You may be thinking that such radical reforms are impossible in the world we’re in. We agree. The irony is that the reforms suggested were outlined centuries ago and prescribed as an economic plan for a nation in its infancy (see Deuteronomy 15 and Leviticus 25). They were the prescription for peace and prosperity, the equilibrium between what is produced and what is bought and sold. And if you read on into Leviticus 26 or Deuteronomy 28, you will note that the implementation of these regulations and principles ensured freedom from the enslavement that comes from indebtedness, an enslavement we are all experiencing now.

This plan is also the blueprint for the world that is yet to come when, instead of a man elected by the will of the people, a real Messiah, appointed and anointed by the will of the Creator, will rule the nations of this world.