Everymoney: Capitalism, Democracy and Global Wealth

Part Three

In the first two articles in this series, we looked at capitalism’s astonishing development up to the late 20th century, with its market-makers and hedge funds. As the 21st century dawned, the democratization of capitalism, made possible largely by the Internet, was in full swing. But where is this seemingly ubiquitous and unstoppable system taking us?

Let’s pick up the story with what scholar Robert Heilbroner calls the Schumpeterian contradiction—an inherent weakness that could be capitalism’s downfall. Austrian economist, finance minister and Harvard professor Joseph Schumpeter (1883–1950) coined the term plausible capitalism. Heilbroner has defined this as the “reasoned model of an economic system that is caught up in a process of continuous self-renewing growth.” The contradiction that Schumpeter recognized is that eventually this self-renewing system turns in on itself. He contended that capitalism is an economic success but not a sociological success. In the end, its own mentality will bring down the system.

In hints of what may come, some today are concerned about the natural tendency of multinational corporations to settle into a sort of giant cartel, dividing the world into private economic kingdoms. Michel Beaud warns in his book A History of Capitalism, 1500–2000 of “the totalitarianism of a market dominated by a handful of giant global corporations, and the growing establishment on a planetary scale of a money-based apartheid.”

“The powers which dominate human society threaten the integrity of man as well as the integrity of the world. The dynamics of capitalism contribute greatly to this process.”

What Have We Wrought?

Perhaps it was inevitable that humanity’s social order would eventually coalesce into capitalism. Historically, society was controlled by tradition and command. When those controls were eliminated in stages, society consigned the production and distribution of wealth to “the market.” Never before had it legitimized the pursuit of wealth by everyone, including the lower classes. Competition and the self-interest of individuals would provide the glue to hold the network of markets together and produce wealth for all. But the irony of it all is that the capitalist system may begin to consume its own constituents, as its “rational” mentality begins to destroy ethical, moral and historic ideologies that governed society for millennia.

Moreover, the globalized free-market system and its supposed handmaiden, the democratic process, may not be the twin saviors that some seem to think they are. Emphasizing the resilience of the nation-state in the face of globalizing trends, economics professor Liah Greenfeld points out in The Spirit of Capitalism that “economic globalization is unlikely to undermine the nation either as a polity or as an economy.” Further, “while their workforce and middle management may be ‘global,’ it cannot be doubted that their character remains emphatically national.”

Counterintuitively, Beaud contends that the link between liberal democracy and capitalism has not been clearly established and that capitalism can prosper perfectly well under dictatorship or strongly nationalistic governments. These are interesting observations, given capitalism’s increasing dominance in the furtherance of many nations’ economic interests.

Other Weaknesses

As any history of capitalism will show, there are many ideas and theories of how economic activity should be conducted. Capitalism is not a monolithic system but is composed of many dynamic strands. Which ideas predominate at any particular time will depend on the perceived needs of the moment and agreements reached. For example, following World War II the preeminent need was to prevent a repetition of the interwar errors of judgment that had proved so disastrous. The world desperately needed monetary stability, economic expansion, and a regime that would encourage free trade.

The 1944 Bretton Woods Conference developed a monetary and economic architecture for the postwar world designed to accomplish these objectives. The International Monetary Fund and the World Bank were its immediate creations. But economist John Maynard Keynes, who played an influential role at the meetings, had actually argued for even more: he wanted to see a postwar world currency, a semi-autonomous supranational central bank, and an international monetary system that would require both surplus and deficit economies to self-correct rather than put the burden solely on deficit economies to deflate. In other words, he believed, whether nations ran a deficit or a surplus economy, all needed to do their part to achieve economic growth and stability in the world.

The framework of this postwar architecture remains in place today and has been largely responsible for the remarkable fruits of prosperity we see all around us. But the gold standard established at Bretton Woods has long since been abandoned in favor of floating exchange rates. And a chorus of voices increasingly calls for reforms more in keeping with the particular needs of today’s world: different circumstances dictate alterations in the way capitalism functions.

Some of those changed circumstances include modern-day global warming—now almost universally understood to be spurred on by human activity. The workings of capitalism have to be urgently modified, say environmentalists, if we are to head off an increasingly likely global catastrophe.

There are also those who take umbrage at the essentially selfish nature of the capitalist system. They object to the unfettered, social-Darwinian, “survival of the fittest”-style workings of the free market and insist that additional international controls are needed to force globalized capitalism to function more equitably. Some observers note that much of the world aspires to live like the upper levels of American society, as universally projected in movies and on TV—that is, in waste and excess—and they further note the futility of such a dream. For that to become a global reality, we would need the resources of several worlds.

Other concerned parties have mounted concerted campaigns for rich economies to relieve the poorest economies of their debts in an effort to end global poverty, and to massively contribute to disease eradication (especially HIV/AIDS) among those nations ill equipped to help themselves. And, of particular current concern, is the fear that a global industrialized agribusiness is fueling the likelihood of disease pandemics such as avian flu.

“In each epoch, capitalism has been both creative and destructive, but today it is the very existence of humanity and the planet which is at stake.”

Schumpeter was already aware more than 60 years ago that the workings of capitalism also undermine the family. Today, in effect validating his point, personal debt in many prosperous nations has reached astronomic proportions. Steven Pressman summarizes Schumpeter’s concern as expressed in the latter’s 1942 book, Capitalism, Socialism and Democracy: “Capitalism is all about satisfying individual wants, while the family requires sublimating one’s desires and compromising. The family, however, is important for capitalism because it is a main reason for saving. Families save so that if anything happens to the main breadwinner, other family members will be provided for. By undermining the motivation to save, capitalism destroys its own foundation—the capital needed for future growth” (Pressman, Fifty Major Economists).

Then there is Nobel prize–winning economist Amartya Sen, who believes the true object of economic activity should not be mere consumption and growth but the development of human potential. The Indian economist suggests that furthering people’s various abilities should be the goal of the capitalistic system: increasing literacy rates, increasing personal options and free choice, being concerned for people and their development, and establishing a society where individuals work for the good of all. He believes that the success of developing economies should be judged by improving life expectancy, literacy, health and education. His concern about people reaching their human potential is aimed particularly at women, who are often seen as an economic drain in the developing world and are therefore undervalued as human beings and less likely to receive necessary food and medical attention when resources are short. The result, in many cases, is untimely death. Sen further makes a distinction between economic growth, which merely raises per capita income and output, and economic development, which improves the lot of all within the community.

There are plenty of reasons, then, to conclude that capitalism today has serious flaws in the way it works, rendering it a far-from-ideal economic system. We see that it was not just Marx who predicted its eventual collapse: today numerous voices are raised in protest that the system needs to be fundamentally changed.

So where does this leave the world’s best economic hope? Are we to conclude that today’s capitalism is the ideal and that there is likely to be none better? It’s also important to ask how the working of capitalism squares with Western civilization’s moral and ethical bedrock, the Bible. More directly, would the God of the Hebrew Scriptures approve of the current dominant economic order?

The Biblical View

The biblical perspective on how economic activity should be organized is a fascinating research project. The economic principles that God prescribes for a just and prosperous society comprise an urgent and essential study. The Bible foretells the coming of a very different social order—a restored world in which economic activity and priorities will be handled very differently and more fairly than they are today. But before such a transformed world comes into being, it forecasts that a system eerily similar to the present one will fail.

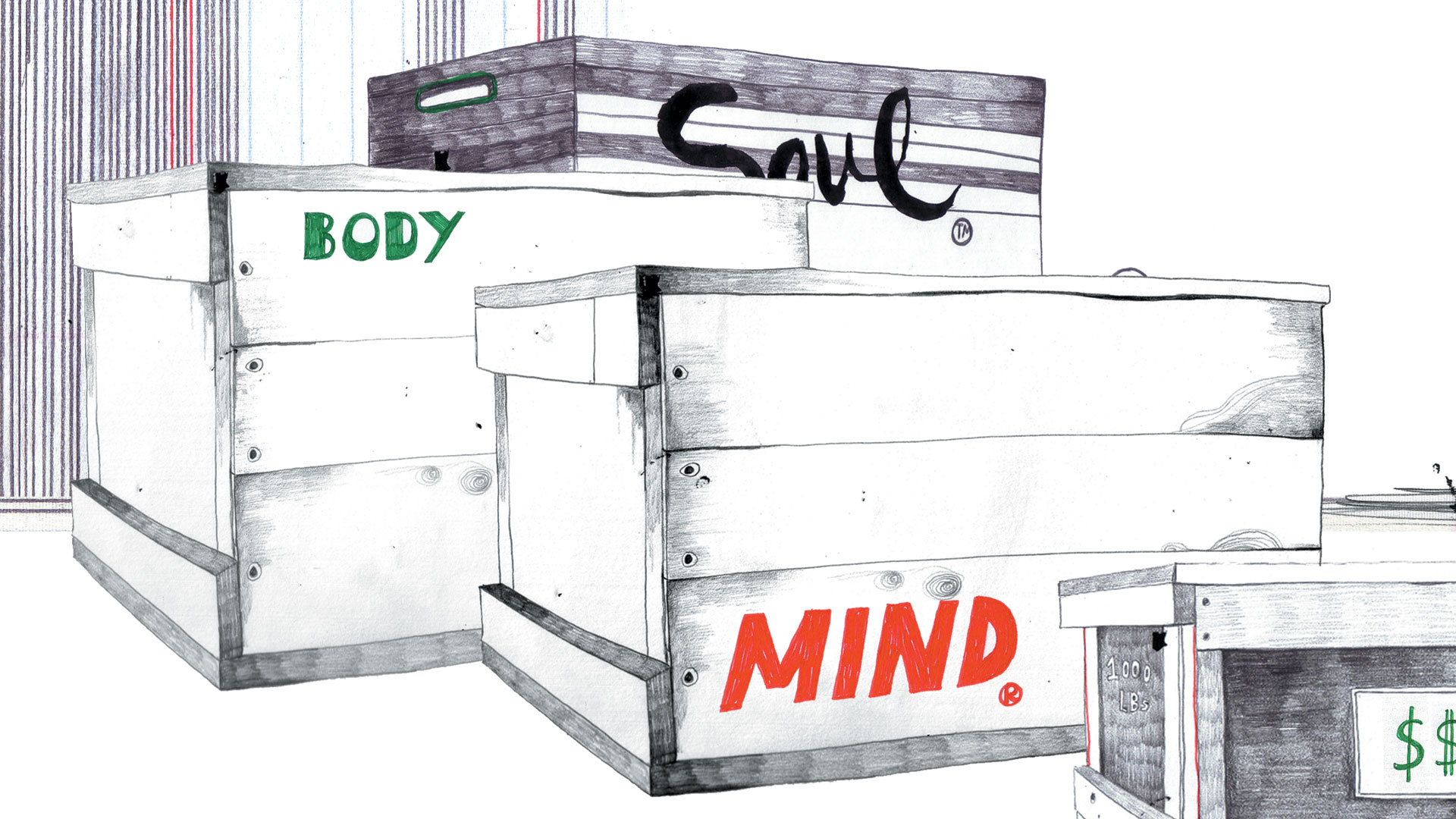

We need only to look at the latter part of the apocalyptic book of Revelation to see the dark side of a globalized capitalistic order, where everything is traded, including even the bodies and souls (lives and destinies) of human beings (see Revelation 18:11–13). It will be a system that exerts complete control over the economies of the world, so that everyone must play by its rules. Such uniformity was not possible prior to the advent of global capitalism, the Internet, the digitization of transactions, and global financial capital movement. This future system will become so dominant and coercive that anyone who does not embrace it will find it impossible to function economically. Acceptance of its underlying “values” and participation in its economy is likened to allowing a “mark” on head or hand (Revelation 13:16–17). Not having the mark will preclude the ability to buy or sell. There will be no opting out of the system without becoming an economic zero.

Chapter 18 of Revelation describes this robust global trading system coming to a violent end. Its demise is pictured in an almost surrealistic metaphor, as the profiteers (those “made rich”) stand off at a distance while their beautiful (and very profitable) system is destroyed to make way for a radically new order.

How Different?

One of the great promises of the Bible is that God will intervene in human affairs in such a way as to bring about the restoration of all things through Jesus Christ and His helpers (Acts 3:18–21; Revelation 20:1–6). It will be a new social order, with a foundation of moral and ethical principles guaranteed to resolve the inherent inequity, selfishness and greed of the best system that man has constructed. It is a paradox that much of the Christian world has turned its back on this key biblical truth; an overwhelming tide of secular thinking has all but eclipsed it. But we can catch a glimpse of how this coming age will work by briefly surveying the biblical principles that will be applied.

The first and obvious difference with today’s world is that all forms of violence will be eradicated, and God’s principles will be understood and practiced (Isaiah 11:19). This will revolutionize all economic planning and activity. Democracy will be replaced by benevolent theocracy. Consider what such a world will be like—a world where the good of all is the overriding preoccupation of a government that is not corrupt and self-serving. All economic activity, whether the provision of energy, the harvesting of fish from the ocean, food from the land, or wood from the forest, will be in harmony with what the environment can sustain. The nature of today’s economic activity will be brought under the kind of direction that will ensure the good of all.

Human nature will at last be subdued, and God’s moral code will become the norm. As people are given the opportunity to understand what God requires of them and they are enabled to make the right choices with the help of a renewed mind, permanent changes will result (Isaiah 2:2–3). Cooperation and collaboration will transform all relationships, as people are convinced that their own interests must be balanced with concern for others. The reality of a future world unified through sound spiritual values is laid out in the major and minor prophets (see, for example, Jeremiah 31:33–34; Zephaniah 3:9).

Debt relief will become standard practice. It is often forgotten that the ancient Israelites were commanded to adopt the year of the Jubilee, whereby all debts were to be canceled every 50 years and property returned to its original owner (see Leviticus 25:8–34). God saw the importance of families having property, with land ownership reverting after a period of loss. In the coming age we can expect that “the Jubilee principle” of debt relief and restored land ownership will be universally applied.

Every help will be extended to those who are poor. The biblical record shows that God is very concerned about the poor. He instituted numerous measures in ancient Israel to ensure that such people were provided for. This included, in the agricultural economy of the day, allowing the poor to reap the gleanings from fields of crops and to benefit more fully every seven years (Leviticus 19:9; Exodus 23:11).

Thus we see that the Bible foretells a time when today’s order will give way to a final destructive phase of humanity’s economic system. The good news is that it, too, will be replaced, but by one founded on benevolent, godly leadership—a global system that finally fulfills the deepest needs of the entire world.